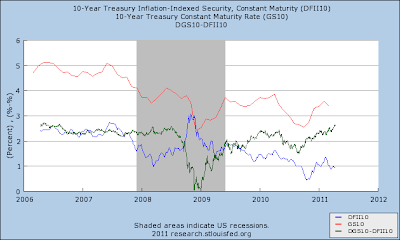

Before we can analyze the spread we have to know what each bond consist of. Nominal Bonds yields consist of two components, real interest rates and inflation compensation. On the other hand we have the Treasury Inflation Protected (TIPS) bonds, whose coupon and principal rise and falls with changes in the CPI (standard measure of inflation in an economy). So the yield on TIPS bonds include only the real interest rate.

So when we take the difference in these bon

ds we are left with what is known as inflation compensation or break even inflation rate. Inflation compensation has two components one is expected inflation and the other is inflation risk premium. Since it is hard to measure inflation risk premium we assume this to be constant and table over time and we say that changes in breakeven inflation captures changes in inflation expectations.

So what does the data show:

If we focus just on the green line which is the difference between Nominal yields and tips yields, we can see the other than the sharp decline during the recession. The spreads show that inflation expectations have steadily been between 2 and 3%.

With the second round of Quantitative Easing, which has done an excellent job of putting the economy on good footing, set to end in June. It we be left up to the federal reserve to gauge inflation and determine if raising of interest rates is justified.

No comments:

Post a Comment